2021 ev tax credit rules

The hybrid tax credit will not increase your refund because it is nonrefundable. The tax credit is also.

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

Rules Committee states that plug-in.

. Status of the 12500 federal tax credit for EVs. When the aforementioned 12 trillion infrastructure bill was passed in November of 2021 House Speaker Nancy Pelosi had planned to also vote on. For vehicles acquired after December 31 2009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity.

Plug-In Electric Drive Vehicle Credit IRC 30D Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. The exceptions are Tesla and General Motors whose tax credits have been phased out. 31 rows 2 days agoThat cap is lifted on January 1 2023 so cars tagged as manufacturer sales cap met will not.

Yes hybrid and electric vehicles may not be a tax write off but may instead be eligible for a credit on your return. After qualifying for federal and California incentives the actual cost of this vehicle would be 22170. Eligible vehicles such as EVs can qualify for up to 7500.

Only vehicles that cost below a. New electric and fuel-cell vehicles will get a tax credit up to 7500. You may be able to get a maximum of 7500 back on your tax return.

The tax credit is also available on fuel cell electric vehicles and plug-in hybrid electric vehicles but the amount can vary based on battery size. The exceptions are Tesla and General Motors whose tax credits have been phased out. Provisions expiring in 2021 2022 or 2023.

June 16 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car. A tax credit means an EV buyer will receive up to a 7500 reduction in their tax liability for the year. Electric vehicles and 500 for US-made batteries.

First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December 2032. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. Updated information for consumers as of August 16 2022 New Final Assembly Requirement If you are interested in claiming the tax credit available under section 30D EV credit for purchasing a new electric vehicle after August 16 2022 which is the date that the Inflation Reduction Act of 2022 was enacted a tax credit is generally available only for qualifying.

Chris Jacobs overstates income eligibility for potential electric vehicle tax credit. If an EV buyer has a tax bill of say 3000 at the end of the year the EV tax. EV Tax Credit Expansion.

There is a federal tax credit of up to 7500 available for most electric cars in 2022. The federal tax credit combined with Californias cash rebate program can reduce the effective out-of-pocket cost of a new EV by up to 9500. The exact amount varies depending on the vehicles battery capacity but electric vehicles have historically qualified for the full amount.

Plug-in hybrids tend to qualify for tax credits corresponding to. To illustrate a 2021 Nissan Leaf has a sticker price of 31670. Some plug-in hybrid vehicles will also continue to qualify.

Is there a tax credit for buying a hybrid car or electric vehicle in 2022. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. The tax credit is also.

This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. There is a federal tax credit available for most electric cars in 2021 for up to 7500. Beginning on January 1 2022.

New York Rep. 421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible. The IRS tax credit for 2022 ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

Congress is considering a new 12500 tax credit that would include 4500 for union-made. The exceptions are Tesla and General Motors whose tax credits have been phased out. The list below excludes any nameplates discontinued before the.

Plug In Electric Vehicle Policy Center For American Progress

Plug In Electric Vehicle Policy Center For American Progress

First Drive Review Volkswagen Id 4 Awd Shows The Way Toward Ev Fun For Millions

Is The 2022 Hyundai Ioniq 5 Eligible For The Federal Ev Tax Credit

Buy An Ev Now Here S How Electric Vehicle Tax Incentives Are About To Change

First Drive Review Volkswagen Id 4 Awd Shows The Way Toward Ev Fun For Millions

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

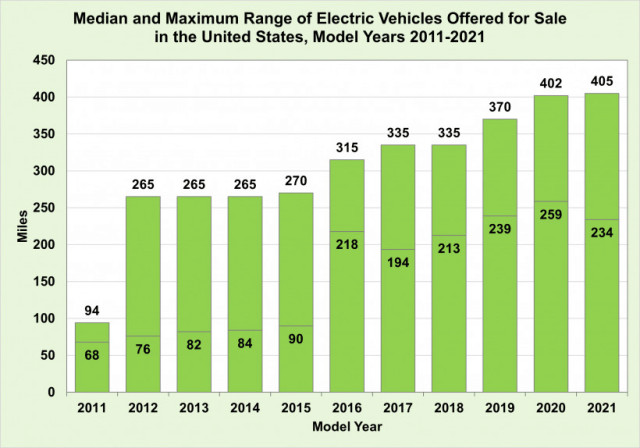

Epa Finds Median Range Of Evs Dropped In 2021

Will An Ev Shift In 2025 2035 Be The Most Transformative Period In The History Of The Automobile

Epa Finds Median Range Of Evs Dropped In 2021

First Drive Review Volkswagen Id 4 Awd Shows The Way Toward Ev Fun For Millions

Us I4 7500 Federal Tax Credit Update Bmw I4 Forum

Rebates And Tax Credits For Electric Vehicle Charging Stations

Approval Of Tax Credit For Union Built Evs Will Face Internal And Foreign Disputes Autoevolution

Plug In Electric Vehicle Policy Center For American Progress

Electric Cars The Surge Begins Forbes Wheels

Ev Tax Credits Thoughts R Cars

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet